A Secure Personal Finance Software Featuring Advanced Budgeting, Automated Bank Sync, Detailed Reporting, Investment Tracking & Bill Reminders for Total Financial Clarity. Get 50% off Moneyspire 2026 now!

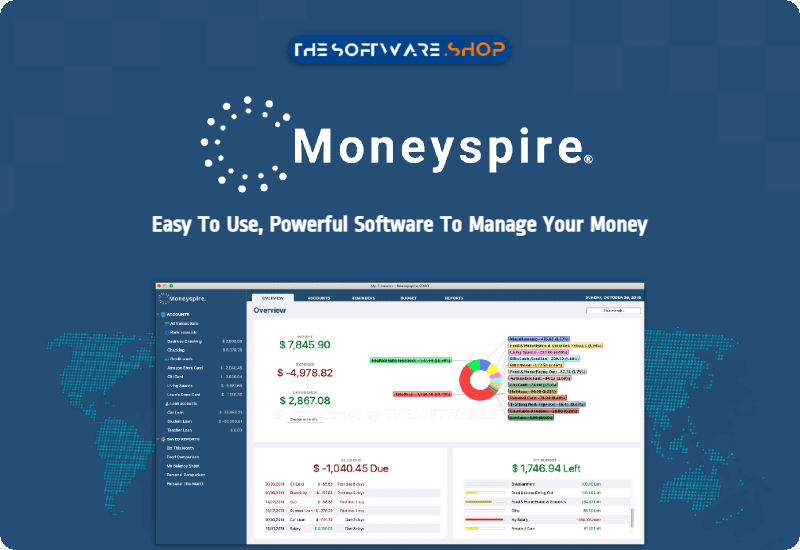

Moneyspire 2026 is the best personal finance software for Mac and Windows to manage your money and budget easily.

Included in this offer:

- Lifetime license – Software (and online features) will never expire

- One time purchase – Not a subscription

- Use on all computers in your household for personal use – For business use, you must buy a license for each computer

- Includes Mac and Windows versions

- Easily move your existing data over to this new version

- Enjoy Moneyspire Connect and Moneyspire Cloud services at no additional cost!

Enjoy risk-free purchase with 60-day Money-back Guarantee

Here is the promotional listing content for Moneyspire 2026, crafted according to your detailed instructions.

Take Charge of Your Financial Future with a Lifetime Solution

Managing personal wealth often feels like a fragmented task, with bank accounts, credit cards, investments, and bills scattered across different platforms. Moneyspire 2026 offers a cohesive, powerful solution designed to bring every aspect of your financial life under one roof. With this exclusive 50% off offer for a lifetime license, you secure a robust money management system without the burden of recurring monthly subscriptions. This software provides the clarity and precision needed to optimize your spending, grow your savings, and plan for a prosperous future. By consolidating your financial data into a single, secure interface, Moneyspire 2026 empowers you to make smarter decisions based on real-time data rather than guesswork.

Gain Complete Visibility Over Your Wealth

The core strength of Moneyspire 2026 lies in its ability to present a unified view of your entire financial landscape. Upon launching the application, you are greeted with a customizable Overview screen that acts as your financial command center. Here, you can monitor your bank accounts, credit cards, cash on hand, and other assets in real time.

The software supports an unlimited number of accounts, ensuring that no part of your portfolio is left unmonitored. You can track standard checking and savings accounts alongside more complex assets like investment portfolios, retirement funds, and even physical assets like your home or vehicle. Conversely, it allows you to track liabilities such as mortgages, car loans, and credit card debt. This holistic approach ensures that your Net Worth calculation is always accurate, giving you a true picture of your financial health at any given moment.

Master Your Spending with Precision Budgeting

Effective budgeting is the cornerstone of financial stability, and Moneyspire 2026 provides the tools to build a budget that works for your unique lifestyle. The software moves beyond simple expense tracking by allowing you to set specific spending limits for customizable categories. You can create budgets for groceries, utilities, entertainment, and more, with the flexibility to adjust these limits as your needs change.

A standout feature is the “Rollover” functionality. If you spend less than your allocated amount in a specific category for the month, the remaining balance can automatically roll over to the next month. This feature mirrors real-life spending habits, where saving in one period can fund larger purchases in the future. Additionally, the software provides visual indicators of your budget progress, using color-coded bars to alert you when you are approaching your limits. This immediate feedback loop encourages better spending discipline and helps you avoid overdrawing your accounts.

Automate Your Financial Life with Moneyspire Connect

Manual data entry is often the biggest barrier to maintaining a finance software. Moneyspire 2026 eliminates this hurdle with Moneyspire Connect, a powerful feature that links directly to your financial institutions. It supports connections to thousands of banks and credit card issuers, automatically downloading transactions and balances into the software.

This automation ensures that your records are always up-to-date without the tedious task of typing in every coffee purchase or utility payment. The system learns from your categorization habits; once you categorize a transaction from a specific payee, Moneyspire will automatically assign that category to future transactions from the same source. This smart categorization significantly reduces the time you spend managing your books, allowing you to focus on analysis and planning rather than data entry.

Secure Investment and Asset Tracking

For those looking to grow their wealth, Moneyspire 2026 offers sophisticated investment tracking capabilities. You can manage all your investment accounts, including stocks, bonds, mutual funds, and ETFs, directly within the application. The software allows you to record buy and sell transactions, track dividends, and monitor the performance of your portfolio over time.

By manually entering or downloading current share prices, you can see the real-time value of your holdings. This integration of investments with your day-to-day banking data provides a comprehensive Net Worth report that is essential for long-term financial planning. You can analyze your asset allocation and ensure that your investment strategy aligns with your broader financial goals, all without needing separate spreadsheet software or logging into multiple brokerage accounts.

Generate Insightful Reports and Forecasts

Data is only useful if it can be interpreted, and Moneyspire 2026 excels at turning raw numbers into actionable insights. The software includes a suite of interactive reports that break down your finances from every angle. You can generate Income vs. Expense reports to see exactly where your money is coming from and where it is going. Detailed category reports reveal spending trends over time, helping you identify areas where you can cut back.

The Balance Forecast tool is particularly powerful for planning. It projects your future account balances based on your scheduled transactions and budget limits. This forecasting capability allows you to anticipate cash flow shortages before they happen, giving you ample time to adjust your spending or transfer funds. Tax time also becomes significantly less stressful, as you can tag specific transactions as tax-related and generate a specialized report to hand over to your accountant.

Never Miss a Payment with Smart Bill Management

Late fees and missed payments can damage your credit score and drain your resources. Moneyspire 2026 includes a dedicated Bill Reminder system that acts as your personal financial assistant. You can schedule recurring transactions for all your regular bills, such as rent, insurance, and subscription services. The software displays these upcoming payments on a calendar and a list view, ensuring you always know what is due and when.

You can configure the system to automatically record these transactions into your register on their due date, or set them to require manual approval for added control. By visualizing your upcoming obligations alongside your current account balance, you can ensure you always have sufficient funds available, effectively preventing overdrafts and the stress associated with living paycheck to paycheck.

Seamless Data Management and Compatibility

Moneyspire 2026 is designed to play well with others. If you are migrating from other personal finance software like Quicken or Microsoft Money, the software supports robust import options for QIF, QFX, OFX, and CSV files. This ensures that you do not lose your historical financial data when you make the switch.

Furthermore, the software offers extensive export capabilities. You can export your data to spreadsheets for custom analysis or to QIF format for backup purposes. For users who prefer physical records or need to pay vendors directly, Moneyspire includes a check printing feature. You can print checks directly onto pre-printed check stock, complete with payee information and amounts, streamlining the payment process for small business owners or individuals who frequently use checks.

Privacy, Security, and Cloud Flexibility

In an era where data breaches are common, Moneyspire 2026 prioritizes your privacy. Unlike many web-only services, Moneyspire stores your financial data locally on your computer’s hard drive. This means your sensitive information is not sitting on a third-party server vulnerable to external attacks. You have the option to encrypt your data file with strong password protection, adding an extra layer of security.

However, the software also recognizes the need for access on the go. The optional Moneyspire Cloud feature allows you to securely sync your data between multiple computers and the Moneyspire mobile app. This hybrid approach gives you the best of both worlds: the security of local storage with the convenience of cloud synchronization. You can record transactions on your smartphone while out shopping, and the changes will be reflected on your desktop when you return home.

Global Currency and Small Business Support

Moneyspire 2026 is built for a global user base, featuring extensive multi-currency support. You can track accounts in different currencies, and the software will handle the exchange rates for accurate reporting. This is ideal for expatriates, frequent travelers, or those with international investments.

For freelancers and small business owners, the software includes features often reserved for expensive accounting suites. You can create professional invoices, track which customers owe you money, and manage your business expenses separately from your personal funds. This versatility makes Moneyspire 2026 a dual-purpose tool that can grow with you as your financial life becomes more complex.

Conclusion

Securing the Moneyspire 2026 Lifetime License is an investment in your financial peace of mind. By providing a centralized, secure, and feature-rich environment for your money, this software equips you with everything needed to navigate the complexities of modern finance. From the granular details of daily transaction tracking to the broad strokes of long-term net worth planning, Moneyspire delivers consistent value. The ability to sync across devices, manage multiple currencies, and generate detailed tax reports ensures that you remain organized and informed regardless of where life takes you. Do not miss this limited-time opportunity to own a premium financial tool forever, free from monthly fees, and start building a more secure and prosperous tomorrow.

Moneyspire 2026, personal finance software, budgeting tool, money management app, expense tracker, bank sync, bill reminder, investment tracker, lifetime license, financial planning, budget planner, check printing software, accounting software for home, small business finance, secure finance app, offline money manager, Mac finance software, Windows finance software, financial reporting, cash flow forecast, net worth tracker, tax preparation tool, multi-currency support, mobile finance app, QIF import.